6 Bursa Counters Worth Looking Into

- MD

- Apr 10, 2023

- 2 min read

Don't missed out these 6 counters which are worth to look into~ Current stock price near to 5 to 10 years low level. Yet, financial reports showed not much fall (or no fall) in earnings performance.

✔ Price at 5 - 10 years low level

✔ Continuous +ve Earnings

✔ PE < 15

✔ Dividends

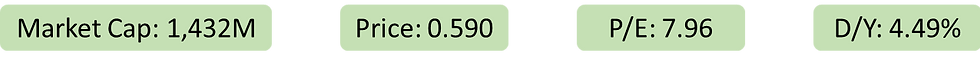

MAHSING 8583

Industry: Property

Business mainly on developing housing. Its also manufacture plastic products.

Price at 10 year low level. Ventured into glove industry while pandemic. While glove stocks starting to fall, MAHSING followed. Yet, its earning performance doesn't like the glove companies fall into red. MAHSING has relative lower performance in 2020, last two years have showed some recover.

Annual Report

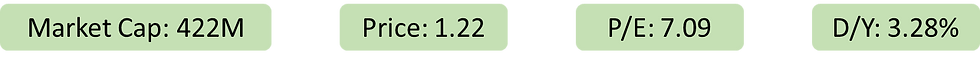

MAGNI 7087

Industry: Consumer Products & Services

Packaging business focuses on consumables, food & beverage, pharmaceuticals and healthcare- related products.

Price near to 5 years low. Company has stable earnings for at least 8 years. Companies revenue and net profit no big fall. Yet, price had fall much from the peak. PE only 7.97.

Annual Report

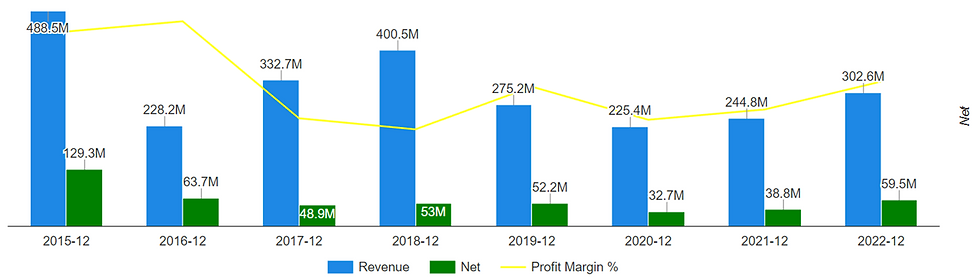

SURIA 6521

Industry: Transportation and logistics

Business mainly on Port operations, logistics and bunkering. It also provide contract and engineering solution.

Price near to 10 year low. Company has stable earning performance. MCO period showed lower profit, and has showed recovery in 2022. We believe the reopening of economy and China reopening could better support its business~

Annual Report

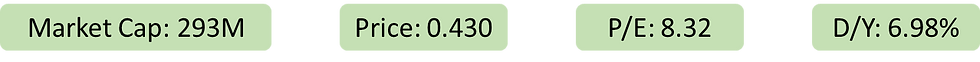

MTAG 0213

Industry: Industrial Products & Services

Specializing in printing of labels and stickers and customized converting services. It also distribute industrial tapes, adhesive and other products.

Price fall near around listed price in 2019. 2 year low level. Yet, earning performance still good and stable. Paying dividend regularly with almost 7% dividend yield.

Annual Report

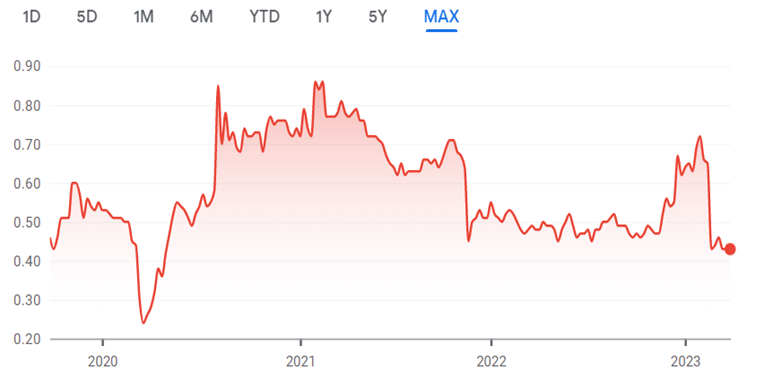

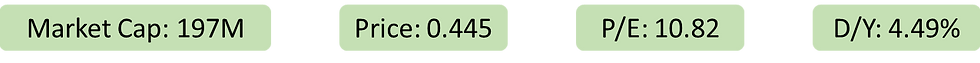

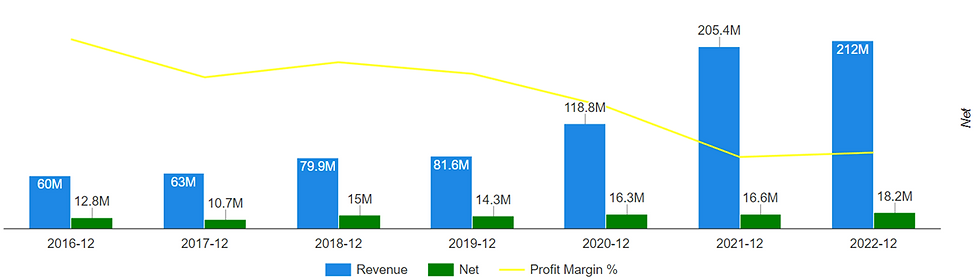

DANCO 5276

Industry: Industrial products and services

Primary involved in trading and distribution of Process Control Equipment and Measurement Instruments.

Earning showed improving gradually. Yet, pricing has retrace near to 6 year low. P/E 10.82. Company paying dividend regularly, with 4.49% dividend yield.

Annual Report

GFM 0039

Industry: Industrial Products & Services

Principally involved in integrated facilities management and consultancy services.

These two quarters showed higher earning due to contribution from new contract (RM340mil). The new contract expiring in year 2027. Its has another main contract worth RM882mil expiring in year 2035. Supporting next few years businesses.

Annual Report

If you wish to open an trading account, you can fill the form below , and we will contact you ASAP~ >> https://forms.gle/59EXxo4JsgeRizow9

* THIS IS NOT BUY/SELL call. Only for reference/record purposes

IF YOU THINK IT’S USEFUL. PLEASE SHARE IT OUT.

BECAUSE IT’S FREE.

Comments