RISK DISCLAIMER

Read On

Services include products that are traded on margin and carry a risk of losses. The products may not be suitable for all investors. Please ensure that you fully understand the risks involved.

Cyclical vs Non-Cyclical Stocks (周期性股票与非周期性股票)

Cyclical stocks Cyclical stocks are those stocks that underlying business performance is dependent on the economic cycles. Meaning...

What is a Dividend value trap?

A company offering a good yield. And you think that you can 100% rely on it. A simple calculation: If the company paying 6% or 7% (D/Y is...

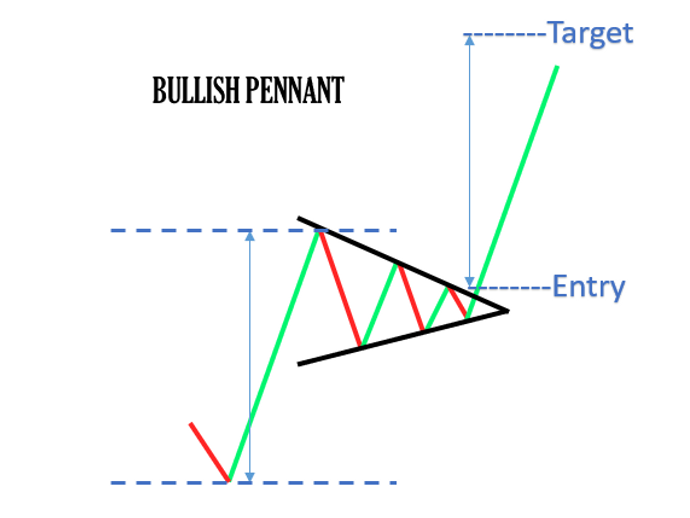

Chart Pattern >> BULLISH PENNANT & BEARISH PENNANT

A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation of trend. Pennant pattern looks alike symmetrical triangle, yet they are different. The differences are pennant includes a flagpole (sharp rise) at the beginning of the pattern, which is not present in the formation of symmetrical triangle. Besides, the duration of Pennant's formation is shorter then triangle pattern. Where Pennant pattern lasts between one to fo

16. Moving Average Convergence Divergence (MACD) 平滑移动平均线

What Is Moving Average Convergence Divergence (MACD)? Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a share’s price. The MACD line is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA.

15. You need a Trading Plan

A trading plan is a systematic method for identifying and trading securities that takes into consideration a number of variables including time, risk and the investor’s objectives . A trading plan outlines how a trader will find and execute trades, including under what conditions they will buy and sell securities, how large of a position they will take, how they will manage positions while in them, what securities can be traded, and other rules for when to trade and when not

2. 2 Types of Stock Analysis

Stock analysis is a method for investors to make buying and selling decisions. By studying and evaluating all the datas, investors...

1. How to Start Invest in Bursa Malaysia

1. Open a Central Depository System (CDS) account. it is like a bank account for you to keep your cash in bank accounts, While this is...

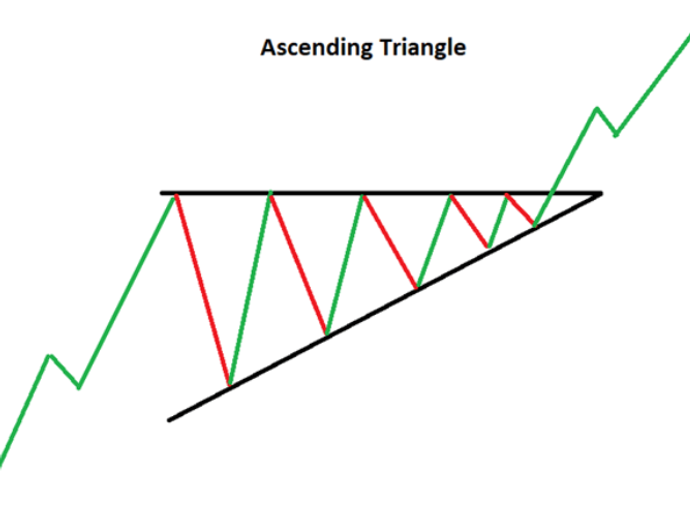

12. Chart Pattern >> ASCENDING TRIANGLE & DESCENDING TRIANGLE

Ascending Triangle

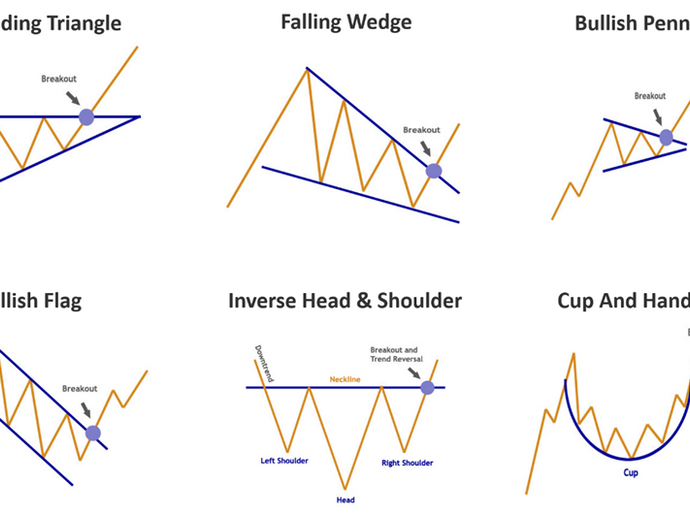

11. What is a Chart Pattern? 什么是图表模式?

A chart pattern is that a technical trader recognizes and can thus anticipate what the price may do next, based on how that pattern has played out when it appeared on prior occasions.

10. Support and Resistance 支撑位和阻力位

The concepts of trading level support and resistance are undoubtedly two of the most highly discussed attributes of technical analysis. Part of analyzing chart patterns, these terms are used by traders to refer to price levels on charts that tend to act as barriers, preventing the price of an asset from getting pushed in a certain direction.

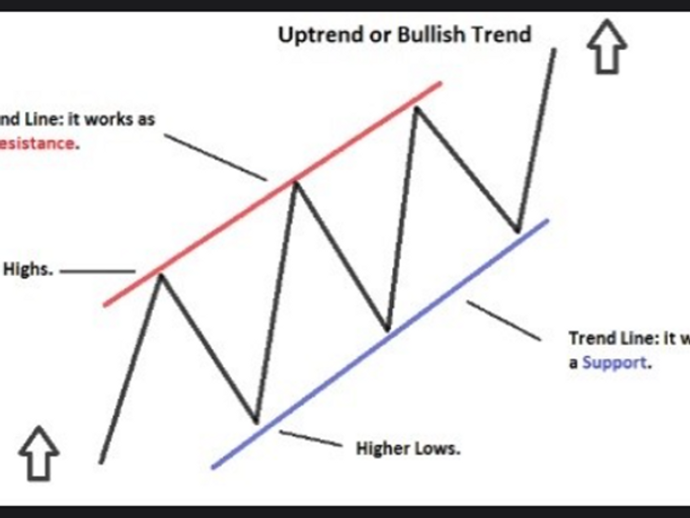

9. What Is a Trend? 什么是趋势线?

A trend is the overall direction of a market during a specified period of time. Trends can be both upward and downward, relating to bullish and bearish markets, respectively. While there is no specified minimum amount of time required for a direction to be considered a trend, the longer the direction is maintained, the more notable the trend.

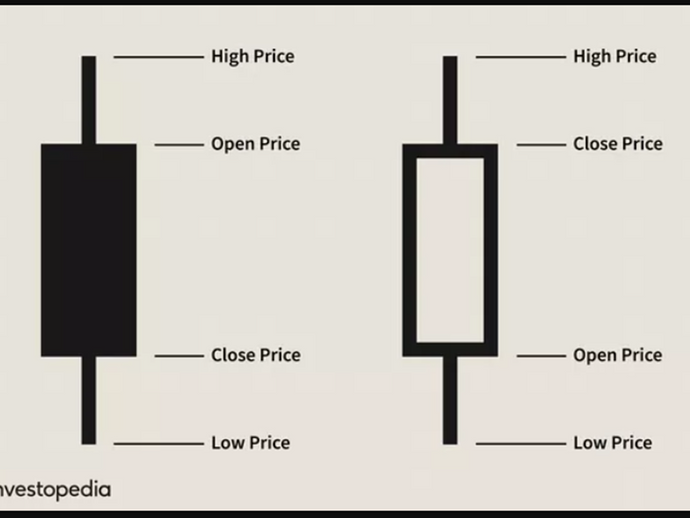

8. TA - Candlestick 蜡烛台

Just like a bar chart, a daily candlestick shows the market's open, high, low, and close price for the day. The candlestick has a wide part, which is called the "real body."

7. What Is Market Capitalization?

Market capitalization, or "market cap", is the aggregate market value of a company. Since it represents the “market” value of a company, it is computed based on the current market price of its shares and the total number of outstanding shares. Market cap is also used to compare and categorize the size of companies among investors and analysts.

6. What Is the Dividend Yield? 什么是股息收益率?

The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

5. What Is Return on Equity (ROE)? 什么是股本回报率(ROE)?

Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity. Because shareholders' equity is equal to a company’s assets minus its debt, ROE is considered the return on net assets . ROE is considered a gauge of a corporation's profitability and how efficient it is in generating profits.

4. What Is Earnings Per Share (EPS)? 什么是每股收益(EPS)?

Earnings per share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company's profitability. It is common for a company to report EPS that is adjusted for extraordinary items and potential share dilution.

3. What Is the Price-to-Earnings (P/E) Ratio? 什么是市盈率?

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.