Cyclical vs Non-Cyclical Stocks (周期性股票与非周期性股票)

- alan cheng

- Sep 28, 2022

- 2 min read

Cyclical stocks

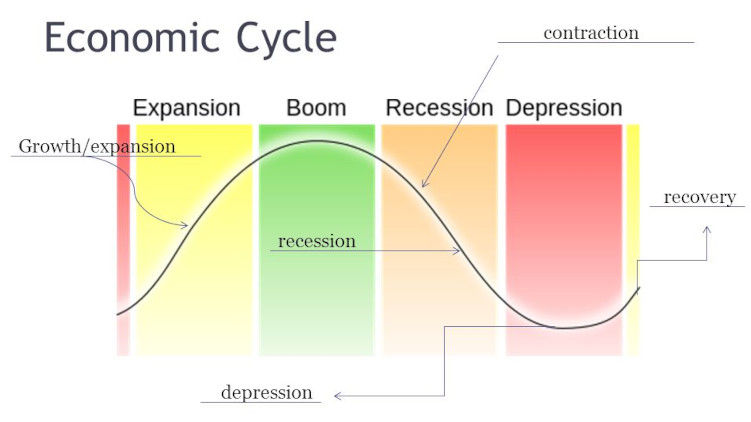

Cyclical stocks are those stocks that underlying business performance is dependent on the economic cycles. Meaning cyclical stocks do share the same trend with the economy. If the economy were bad, the stock prices go down. When the economy goes up, the share prices will follow and turns upwards.

Those high-end/branded/premium goods and services that the public might consider cut first when the market and economy are tough. This is the reason why the stock price for cyclical stocks will tend to go down as their business revenue were impacted. Now, I can think of the Automobiles, Manufacturing and Technology sectors as well.

Non-Cyclical stocks

Non-Cyclical Stocks are sometimes also called defensive stocks as their business mode/ revenue does not impact by the economic movement (OR maybe lesser).

And non-cyclical stocks normally perform better during economic growth slows. The only bad thing is the stock price for the non-cyclical stock will not shoot to the sky when the economy grows.

For Example, Utilities, gasoline pharmaceuticals/ healthcare, tobacco, and alcohol...

周期性股票

周期性股票的公司业务表现取决于经济周期的股票。周期性股票确实与经济有着相同的趋势。如果经济不景气,股价就会下跌。当经济上升时,股价将跟随并转向上行。

当市场和经济困难时,公众可能认为的高端/品牌/优质商品和服务首先被削减。这就是为什么周期性股票的股价会随着业务收入受到影响而趋于下跌的原因。

让我联想到汽车行业,制造业和科技板块。

非周期性股票

非周期性股票有时也被称为防御性股票,因为它们的商业模式/收入不受经济走势的影响(或者比较小)。

非周期性股票通常在经济放缓期间表现更好。唯一不好的是,当经济增长时,非周期性股票的股价不会飙升。

例如,公用事业,汽油,制药/医疗保健,烟草和酒精,这类型的板块。

Comments