KPJ selling out its Indonesia hospital? A good or bad action?

- alan cheng

- Mar 9, 2023

- 2 min read

2 years after MCO. Malaysia market reopen. Healthcare and Gloves counter back to normalised.

Check through the performance of KPJ 5878 (Health Care sector). KPJ 5878 Company Structure:

In short, KPJ Specialist Hospital covers the whole of Malaysia.

ANNUAL REPORT:

Annual report recorded 8 years of revenue and net profit. 2 years slowing down in year 2020 and 2021.

2022 Revenue and Net profit seem to have a pickup.

Company prospects For the financial year ended 31 December 2022, the Group delivered sterling performance and results as the transition into endemicity and re-opening of international borders has contributed positively to the increase in economic activities. The Group has seen a resurgence in overall healthcare services throughout its network of hospitals. The current year results show that the Group has exceeded its pre-pandemic performance. The Group is optimistic on the outlook of the healthcare industry as it moves beyond the pandemic phase in 2023. The global economic recession and inflationary pressures may pose some downside risks to demand and costs. However, the Group remains focused in improving its operational efficiency and expanding its existing capacities as it strives to deliver excellent patient care, contributing to a better customer experience. The turnaround in health tourism sector presents an upside which the Group is well-positioned to leverage on as Malaysia remains a top medical tourism destination in Asia.

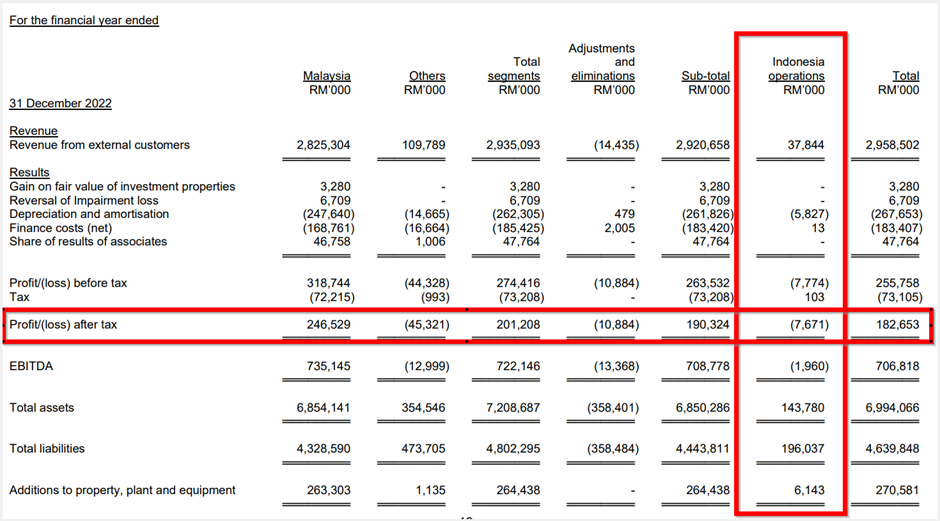

Recently KPJ was selling Indonesia’s stake. Seems a good move as QR shows Indonesia’s business was in red. Sell-off the losses company and focusing in Msia were not a bad move.

The share price for KPJ was back to 2022’s high (Rm1.17) recently.

Current PE 29.89~ Slightly higher~

IF there’s any pullback, it’s a good opportunity to collect.

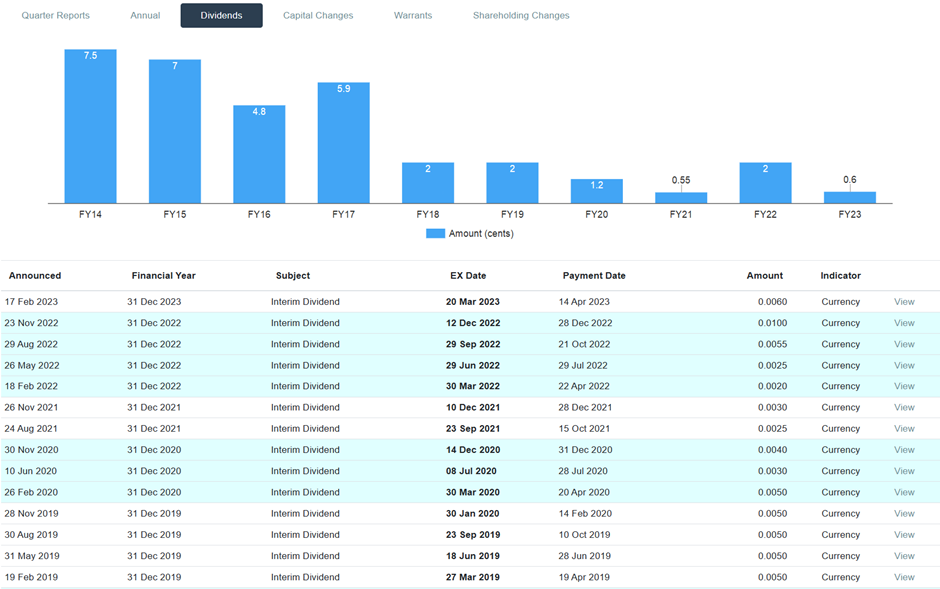

Dividend History

Before MCO, dividend pay-out was quarterly. In 2020 and 2021, the company pay lesser and fewer times of dividends following the drop of net profit in that year.

Last year 2022, back to normal dividend pay-out quarterly. A small drawback was the dividend getting lesser. (D/Y equivalent to 1.72%)

Rating from Research House

KPJ Healthcare Bhd is the healthcare sector top pick by RHB Investment Bank Bhd, due to its robust patient growth trajectory, lower impact from nurse shortages, and disposal of its loss-making Indonesian unit.

Rating "Buy" by KENANGA, PUBLIC BANK, RHB, BIMB and HLG.

Comments