BNM Raises OPR to 2.25%

- alan cheng

- Jul 7, 2022

- 1 min read

OPR increased for the second time this year, Most likely another raise on Sept. What Is Overnight Policy Rate (OPR)?

OPR is an overnight interest rate set by our central bank which is our beloved Bank Negara Malaysia (BNM). The Bank Negara will determine the rate of interest for financial institutions that lend each other money overnight.

Why is OPR so important?

This is because banking interest rates (FD %% & Loan interest %%) defined by OPR provide the framework for monetary direction on a national level that ensures banks have a stable supply of available cash.

The OPR is so fundamental to the workings of our banking system, changes to the OPR rate often have a domino effect on a range of other economic factors beyond simply lending rates. How does OPR impact you?

The higher OPR is set, the higher the cost of borrowing would be.

This would mean that there will be fewer capital financing opportunities for people and businesses as banks would tighten the prerequisite requirements for both personal and businesses to secure loans.

This might hurt the growth and sustainability of small enterprises that needed capital injection into their businesses.

With a rise in interest rate, the cost of production will increase. It burdens the Malaysian and kills all the purchasing power.

What could you do now?

- Manage your funds

- Reduce your unnecessary liabilities.

- Invest in yourself

- Multiple income sources

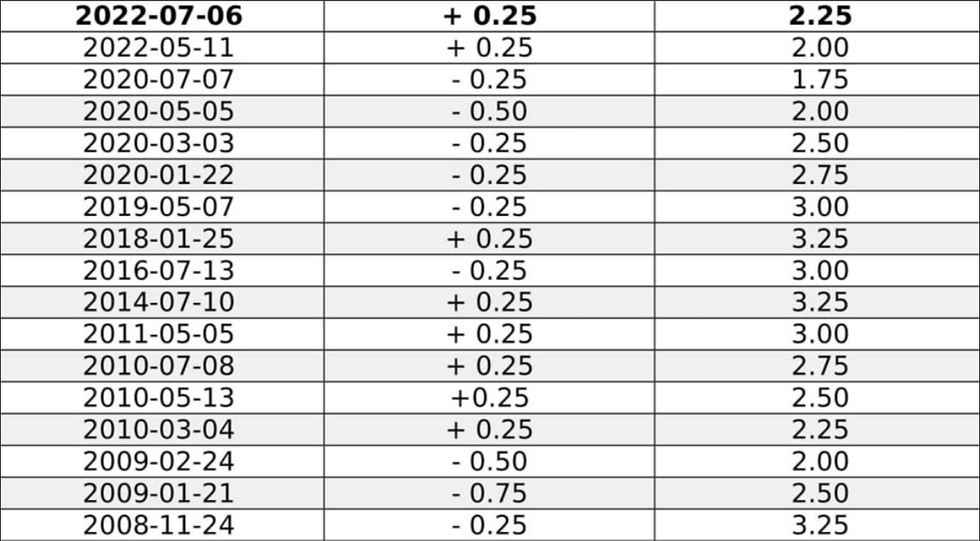

Attached the historical OPR movements.

Comments