Invest For Dividends

- MD

- Jun 16, 2022

- 3 min read

Updated: Jun 20, 2022

Looking for high dividend stocks?

Let's check out these five companies~

Taking historical performance as reference.

These 5 companies showed at least 5 years stable and positive earning, as well as dividend payout every year.

STOCK NAME & (CODE) of these 5 companies: > ALAQAR (5116) > RCECAP (9296) > PETGAS (6033) > SENTRAL (5123) > KIPREIT (5280)

> PETGAS (6033) - PETGAS is one of the Top 10 biggest listed companies in BURSA Malaysia. Company made RM410.6 million net profit in the first quarter of 2022. Assume the company make the same profit for next 3 quarters, net profit for 2022 will be RM1.64 billion, EPS will be 83, and PE will be 19.78 at price 16.42. Estimate will have a little drop in 2022 performance with this assumption... According to the quarter report, the lower net profit in the first quarter of 2022 is due to lower Utilities margin following higher fuel gas prices coupled with higher operating costs at Gas processing. Oil price remained high in April, May and June 2022. Thus, expecting the net profit for next quarter (for quarter April - June 2022) may also affected from lower profit margin as oil price remained high. Investor can consider to wait for a lower price if interested in this counter. > RCECAP (9296) - Company showed year-on-year revenue and net profit improvement for 7 years. Instead of banking, RCECAP is the one which could benefited on Overnight Policy Rate (OPR) hike too as company giving financial services like banking. OPR is the rate of interest for financial institutions that lend each other money overnight. The average PE of financial services sector is 12.5. Therefore, it is worth to collect as company growing and PE not at a high level (below 10), which consider share price is undervalued.

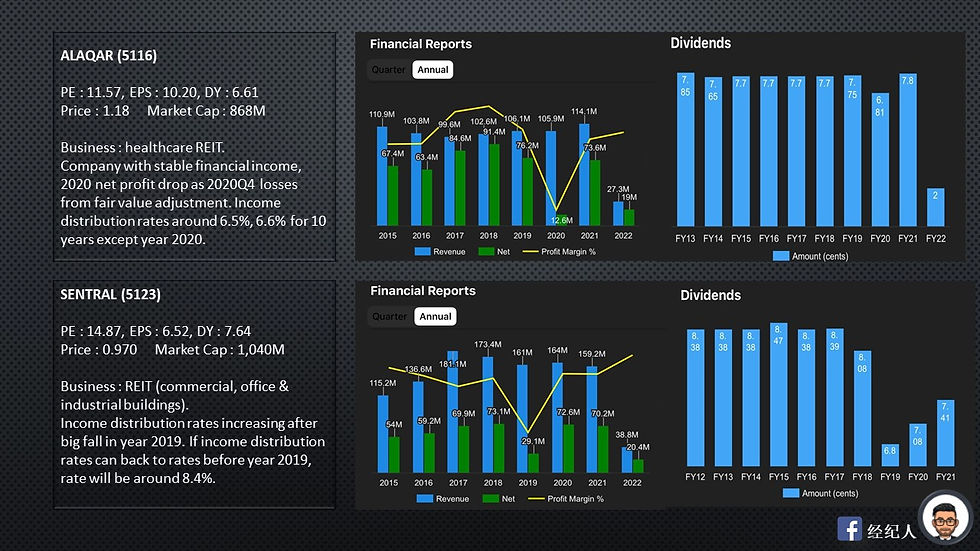

> ALAQAR (5116) - ALAQAR is a Malaysia based real estate investment trust. Focusing on investing in healthcare-related real estate like hospitals and wellness/health centers. Company showed a stable profit from the past 7 years except year 2020. The drop is due to the losses from the forth quarter of 2020. Company made RM19 million in the first quarter of 2022. Assume the company make the same profit for next 3 quarters, net profit for 2022 will be 76 million, EPS will be 10.32, and PE will be 11.43 at price 1.18. Expecting will show a stable result for this year too~ > SENTRAL (5123) - SENTRAL engaged in the acquisition of and investment in commercial properties, primarily in Malaysia. Its buildings include Quill Building 1-DHL 1, Quill Building 4-DHL 2, Quill Building 2-HSBC, Quill Building 3-BMW, Plaza Mont' Kiara, Quill Building 5-IBM, Tesco Building, Platinum Sentral and Menara Shell, Wisma Technip, and Quill Building 8-DHL XPJ... Company made RM20.4 million in the first quarter of 2022. Assume the company make the same profit for next 3 quarters, net profit for 2022 will be 81.6 million, EPS will be 7.6, and PE will be 12.76 at price 0.970. If the dividend payout back to 80sen+ (before pandemic), dividend yield will be 8.64% per annum.

> KIPREIT (5280) KIPREIT is a Malaysia based real estate investment trust, focused on retail property trust. Its portfolio consists KIPMalls located in Johor, Negeri Sembilan, Melaka and Selangor. Its properties include AEON Mall Kinta City, KIPMall Bangi, KIPMall Masai, KIPMall Kota Tinggi, KIPMall Tampoi, KIPMall Melaka, and KIPMall Senawang.. Company listed on Bursa Market in year 2017. Company showed positive and stable earning, as well as high dividend payout in the past 5 years. Company made RM26.5 million in the first 3 quarters of 2022. Assume the last quarter, company make the same profit as last quarter (RM9.1 million), net profit for 2022 will be RM35.6 million, EPS will be 12.66 at price 0.895. **Information outside give you an idea on picking shares. But, you may do some own work to check first if you're planning to put your money in the market~ As you, yourself are the only one who have to be responsible for your own actions.

Comments