MPI 3867

- alan cheng

- Mar 22, 2022

- 1 min read

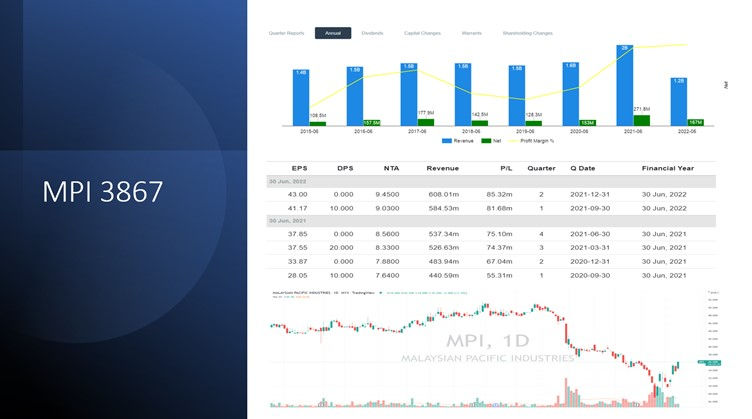

Does MPI looks expensive to you? Yes, No or maybe~ lets see what we can found in the reports.

Revenue (‘000) 2019 – 1,487,942 2020 – 1,564,600 (+5.1%) 2021 – 1,988,489 (+27%) 2022 (1st half) – 1,192,531 (Achieved 59.9% compared 2021)

Net Profit (‘000)

2019 – 128,328

2020 – 152,989 (+19.2%)

2021 – 271,819 (+77.6%)

2022 (1st half) – 167,004 (Achieved 61.4% compared 2021)

Next would like to do the forecast for MPI worth value~ lets assume 20% growth of EPS from 2021 (137.32sen)

Which mean for 2022, EPS could achieve 164.78

with the industry PE of 33.

the share price could go up to Rm54.37

Now the share price were Rm36.00

Theoretically, there’s 50% of upside potential.

What do u think?

Comments