Trade data released; 1 sector that you should monitor~

- MD

- Oct 19, 2022

- 1 min read

The market is temporarily back to 1400. All eyes are watching BANKING counters as they pay good dividends and an increase in interest rate will definitely improve their business margin as they are the only beneficiary in the market. Besides of Banking sector, there is another sector that I think is worth monitoring which is our Technology E&E sector.

Today, MITI just announced our trade data were rising 31.4% to Rm256.91bil compared to the same month last year. It was the 20th consecutive month of double-digit growth.

Our Export increased by 30.1% and imports also expanded by 33%. Export growth was contributed mainly by ROBUST EXTERNAL DEMAND FOR E&E PRODUCTS, petroleum products, and liquefied natural gas (LNG). http://www.theedgemarkets.com/article/malaysias-september-trade-314-rm2569b#.

Petroleum products and LNG might be affected by the oil price movement.

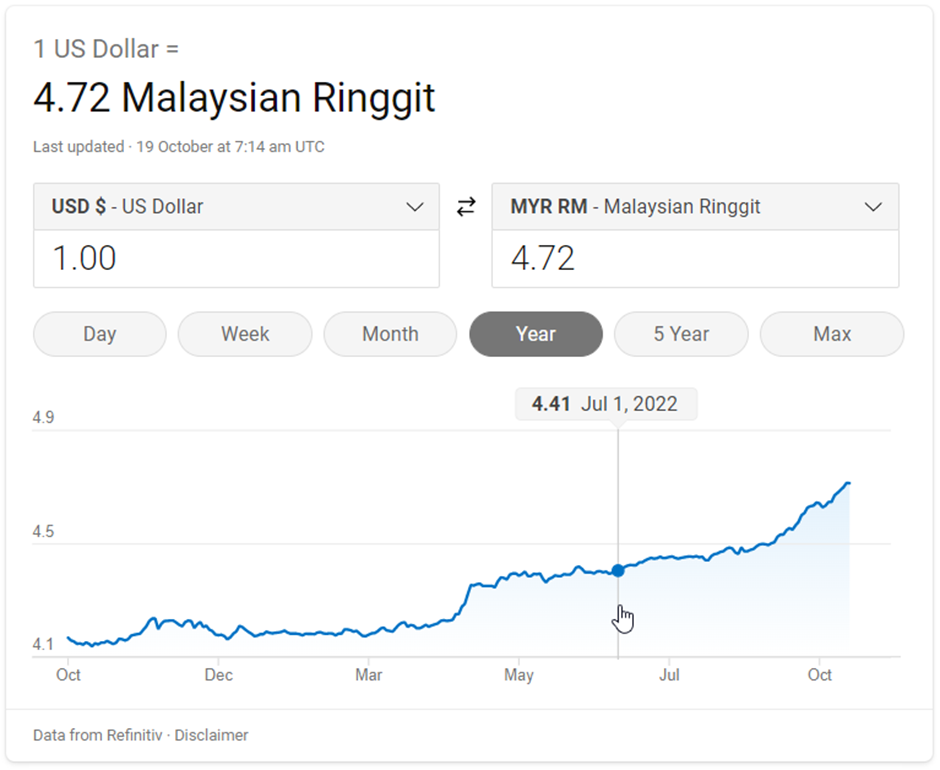

Personally, I think the improved trade data is because of the weakening MYR.

From July, MYR depreciated 7% to Rm4.72. From March to June, MYR depreciated 5%+ from 4.19 to 4.41.

MYR depreciating means the importer can use the same amount of money to buy more goods from Malaysia.

For Malaysia, our manufacturer/exporter can close more business and benefit from weaker MYR/USD. Exporting the same product same price in March and in Oct will have a 12% different in the margin.

In conclusion, we knew that...

our E&E product export numbers improved.

MYR/USD weakening

business margin improved

This is why I said our Technology E&E sector is worth to monitor~

Comments