What would your pick as high crude oil price

- alan cheng

- Mar 23, 2022

- 1 min read

Jan till March

Crude oil price shooted up from USD$74.27 to USD$130.50.

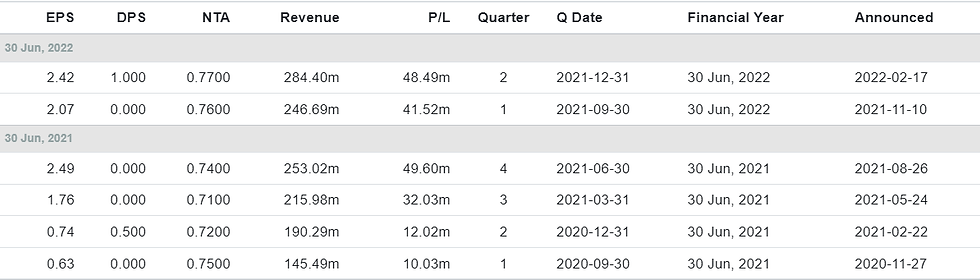

5199 Hibiscs Also surged 73.5% from Rm0.795 to highest Rm1.38 in first quarter 2022. Do you think Hibiscs still worth to buy?? Latest quarter report ended 31 Dec, Hibiscs announced Revenue 284.40 million and Net Profit of Rm48.49 million.

According to their QR, In North Sabah, A total of 587,374 bbls of crude oil were sold in two offtakes at an average realised oil price of USD75.15 per bbl.

Anasuria Hibiscus, Sold 256,224 bbls of crude oil (which included the overlift volume of 90,000 bbls) at an average realised oil price of USD72.02 per bbl. However, the crude oil price from Jan - March is traded between ( USD$74.27 - USD$130.50 ) Assuming the average price were selling USD$100 for the current quarter, theres' 30% diffrent from their previous QR USD$75. Next, EPS for 2021 is 5.62 ( 0.63+0.74+1.76+2.49 ) for 2022, 1st half already 4.49 (2.07+2.42) which is 79.8% of 2021. Assuming next 2 quarters EPS can hit 2.2 (which i consider conservative) EPS would be 8.89 (2.07+2.42+2.2+2.2) With standard PE 15, The share price would be around Rm1.33 So, would you consider support and buy Hibiscs now??

Comments